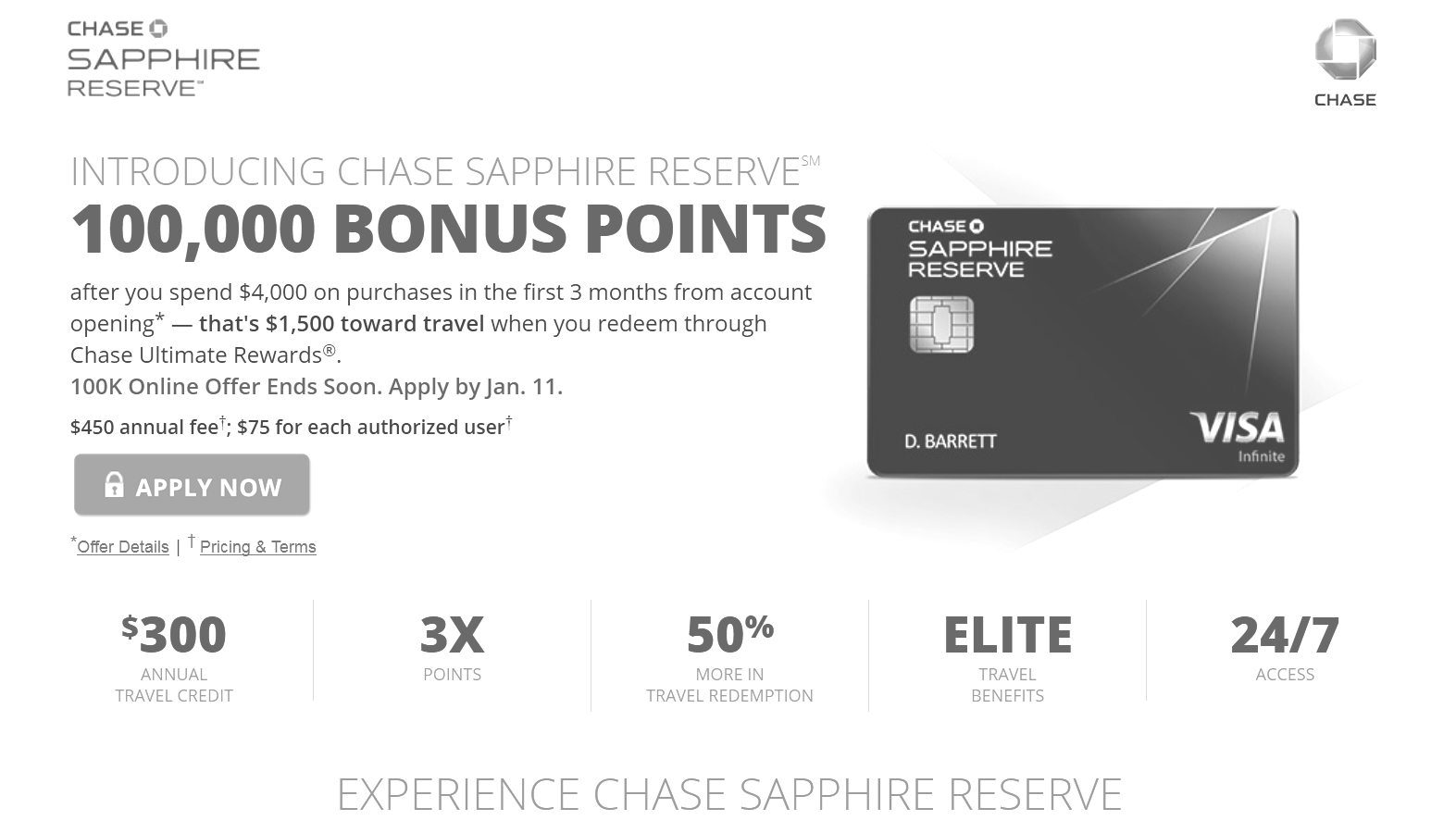

When Chase launched its Sapphire Reserve Visa card in August 2016, it was big news. The 100,000-point sign-up bonus for the card was one of the highest-ever such bonuses, for one of the best-ever travel rewards credit cards. But while the card itself was designed for the long term, that outsized bonus was never destined to remain in place forever. It was more than rich; it was unsustainably rich.

According to Bloomberg, the costs associated with the bonus dragged down Chase’s fourth-quarter profit by $200 to $300 million. So it should come as no surprise that Chase will be scaling back the offer.

As reported by the New York Times, beginning on January 12, instead of the current 100,000 points, new Sapphire Reserve customers who enroll online will earn 50,000 points after spending $4,000 within three months. Chase banking customers will still be able to earn the larger bonus until March 12, but only when enrolling for the card at a bank location.

A 50,000-point bonus is still substantial, worth around $750 when redeemed for flights through the Ultimate Rewards portal, and keeps the Sapphire Reserve card’s sign-up incentive competitive with other higher-end rewards cards. But with the card’s $450 annual fee and the lesser bonus, prospective cardholders will have to think longer and harder to justify committing.

The card in brief:

- Annual fee: $450

- Earn 3 points per $1 spent on travel and dining, 1 point per $1 for other spend

- Points transfer 1:1 to 11 airline and hotel loyalty programs

- Annual $300 credit toward travel spend

- $100 fee credit toward Global Entry (which includes TSA PreCheck)

- Priority Pass membership for access to 900 airport lounges

- Primary rental-car insurance

- Trip cancellation/delay coverage

- Reimbursement for lost luggage

- Free roadside assistance

- No foreign transaction fees

That $450 annual fee puts the Reserve card at the upper end of pricey rewards cards, alongside the likes of the American Express Platinum card, the Citi Executive AAdvantage WorldElite MasterCard, the Delta Reserve Credit Card, and the United Mileage Plus Club Card. Like those other cards, the Chase Reserve card makes the case that the value of the associated benefits far exceeds the high annual fee. And certainly it does, in theory.

When redeemed for flights through the Ultimate Rewards portal, the 100,000 bonus points alone are worth $1,500. Add to that the $300 travel credit, the $100 Global Entry credit, and the $399 Priority Pass membership, and the first-year value of just those benefits is well over $2,000.

The insurance adds yet more economic value to the card, and the points’ convertibility into other program currencies gives the card a measure of flexibility that’s hard to beat.

If you travel regularly and can utilize many of the card’s perks, there’s a compelling economic argument to be made for spending $450 a year for it, whether the bonus is 100,000 or 50,000 points. Otherwise, the Chase Sapphire Preferred card, with a more modest $95 annual fee, waived the first year, might be a better option. It comes bundled with a lesser set of perks, but a hefty 50,000-point bonus.

If you can make the case for the Reserve card, do apply by January 11, before the sign-up bonus is cut in half.

After 20 years working in the travel industry, and almost that long writing about it, Tim Winship knows a thing or two about travel. Follow him on Twitter @twinship.

This article first appeared on SmarterTravel.com, where Tim is Editor-at-Large.

Leave a Reply